I was a BDO user for more than 10 years. It all started in Makati. My BPO employer uses BDO ATM to pay our salary and commission. Then after the pandemic, I got transferred to my hometown Talisay City, Negros Occ, working as a VA for another 3+ years up to now.

I was a BDO user for more than 10 years. It all started in Makati. My BPO employer uses BDO ATM to pay our salary and commission. Then after the pandemic, I got transferred to my hometown Talisay City, Negros Occ, working as a VA for another 3+ years up to now.

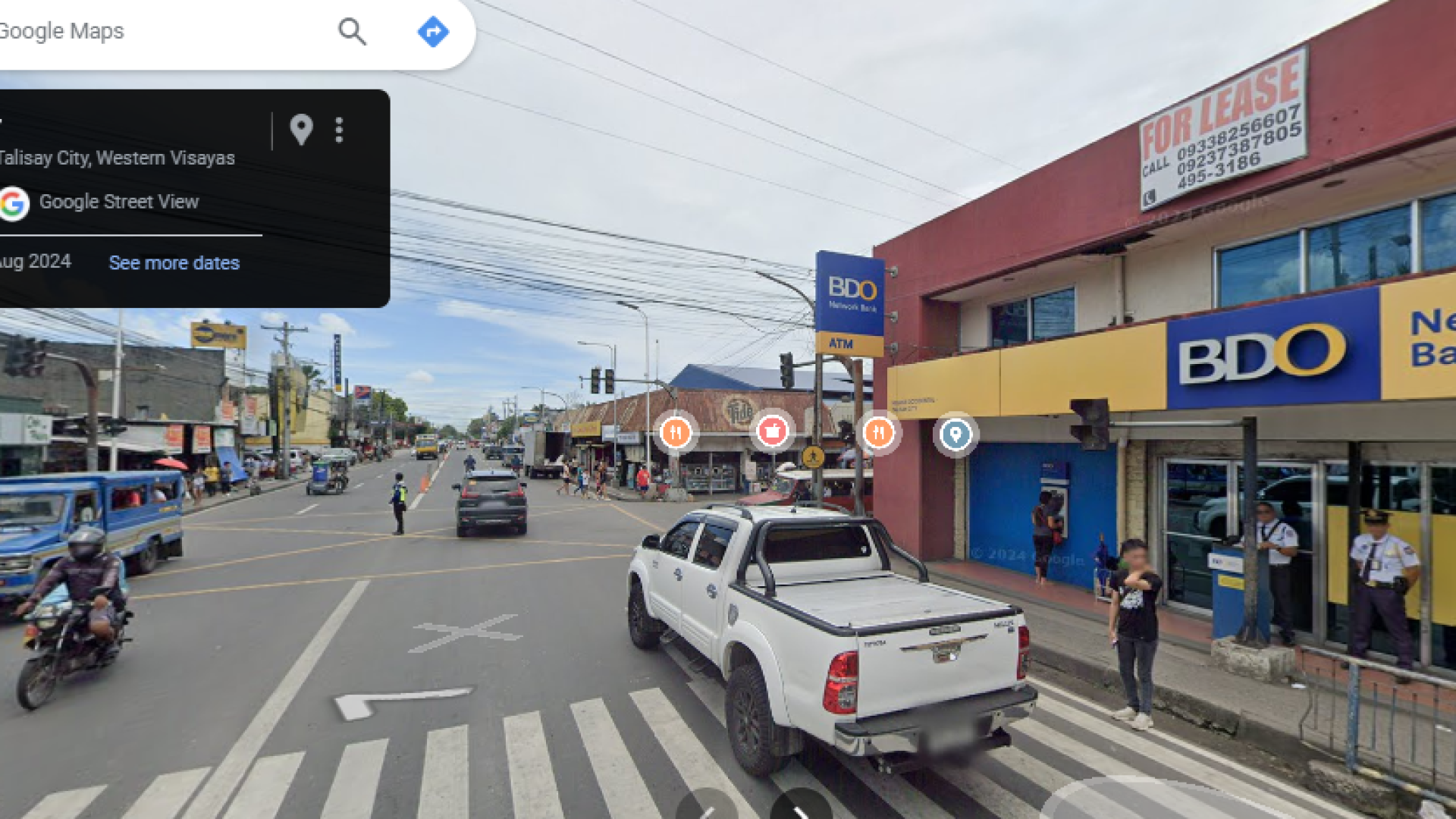

It’s a good thing that there are 2 brands of BDO in my hometown, so there’s no need for me to go to Silay or Bacolod to withdraw cash from my salary.

I even used it to receive money from abroad for my blogging side gigs and fund my e-wallet also to pay my foreign associates in a snap of a finger.

I grew up in the market and have several family members and friends who fell into a trap via loan sharks. Although some market vendors or businesses succeed, the majority, in my own observation, are trapped in a mountain of debt.

Although it was told publicly, it is still quite difficult to explain to the majority. Imagine you borrow 5000 pesos from a lender and pay it 6000, which is 20% interest, in just one month. That’s a lot! Compare to BDO in the diagram above. We are talking about at around 7% per annum interest rate, which means you can borrow from 10,000 to 1 million to grow your business.

Although I also utilized loans when I opened and operated several businesses, 20% is just too much for a month. To my fellow Talisaynons, the 2 branches of BDO are just beside and within walking distance from the public market. Feel free to inquire or visit if you want to borrow to expand, have an emergency, or grow your business.